While I am not an economist, it's clear that we're in a severe recession. We're in this recession for many reasons.

Unfortunately, we're dealing with "fundamentalist economists" - people who will always tell you that there is only one way to do something, regardless of empirical evidence. Conservative economists will insist the trickle-down effect of lowering taxes on the rich is the way to go. This may have worked in the early '80s and early '00s, but it clearly hasn't worked in a few years [2012 update - Actually, I'm wrong about this - there's evidence that "trickle down" did not work in the '80s either]. If anything, this may have sent the economy more into the tank. Liberal economists will insist that massive spending programs are the only way to bolster the economy. That might have worked some in the late '30s and the late '60s, but it doesn't work for very long and can lead to additional years of recession.

Different times call for different solutions.

Much as I abhor federal deficits, we need massive but targeted federal spending and that taxes must be raised on people making more than $100,000 a year. This is not the time for trickle-down - this is the time for building up. Our infrastructure is in horrible shape after years of governmental neglect. How many more bridge collapses are we going to have to have before people wake up and see how badly we need another big roads bill? Our government should also be employing more modern methods, such as green energy plans, online medical records and modernizing public education.

Economic isn't physics. Physics describes laws that are consistent. Economics is a much softer science than its practitioners would care to admit. If I drop a ball from the Empire State Building and one from a 737, it's going to always fall at the same rate of speed. Gravity is a constant. But economies do not fall or rise at a constant rate. Psychology plays heavily into economics. After years of irrational exuberance, we seem to in a state of near-irrational economic despair.

Americans deserve some of that despair. Both the investing market and the housing market went completely bonkers over the last few years, because there was almost no oversight. Common sense by governments, institutions and individuals went completely out the window.

My husband and I have been doing pretty well over the last few years. While I have been unable to remain reliably employed, my husband has a good job and we've always been careful about spending. We have savings and a diversified portfolio of investments.

We bought our first house in 1987 and our second in 1993. We put 5% down on the first house and 20% down on the second. We had good a good credit rating. Of course we sweated getting our first mortgage a little, but we knew we'd get it.

We sold our first house during a housing downturn in 1994 and lost money. We had a lasting lesson that housing prices don't just go up. And, this was in Massachusetts, a place where the housing market, after 1994, went from being expensive to being extremely expensive.

In 2006, we decided to buy a new house. As my husband manages his group from home and I was unemployed, we could have moved anywhere. After looking at housing prices in several areas, we decided to stay in Pittsburgh, where we have family and friends and could buy much more home for the money. For the same money that bought a largish, new house in rural Western Pennsylvania would have bought a 50 year old ranch in eastern Massachusetts or a one car garage in the Bay area of California. We wanted the space and the quiet, so we stayed here. We're very glad we did!

We put 20% down on our new home. Our mortgage broker tried to talk us out of putting that much down. We were stunned by this attitude, but put 20% down anyway, and later paid most of the money from the sale of our old house (which took nearly six months to sell) against the principal of the new. We also worked to keep the costs of our mortgage as low as possible. Selling stock to buy a house in early 2006 turned out to be a very good move, and staying in the Pittsburgh area was a real win. While the housing prices peaked around then, our house has lost much less value than our stocks have. Since the Pittsburgh housing market had a huge bust back in 1980-1981, it's lost very little value during this housing bust.

While I understand that mortgage brokers and banks were trying hard to get people to buy houses a few years back, their "you don't need to put money down" attitude was incredibly short-sighted. Many people don't understand the importance of paying principal on houses and other investments. While laws should encourage home ownership, they also need to encourage people to put money down, to actually own a percentage of the property.

We could have probably gotten a million dollar mortgage in California or New York, but we would have had barely invested 5% in a house in one of those markets. Living that far beyond our means was completely unacceptable to us. Unfortunately, it wasn't unacceptable to many Americans who did just that over the last 10 years or so.

And that goes for government spending too. The federal government has been mortgaging our children's and grandchildren's future without making the rich pay more taxes. Over the last few years, the number of yachts and luxury mansions owned by Americans skyrocketed. Why do you think that happened? Because the super-rich were the biggest beneficiaries of the Bush tax cuts. Wealthy Americans who can afford to pay more taxes should be paying more taxes. Much as I respect President Obama, his refusal to kill the Bush tax cuts for the rich and give the rich yet more tax breaks was a horrible way to start off his administration.

So what we need is a rational tax/stimulus package includes:

We need to look at new, logical ways to manage the economy, without being rigidly bound to the theories of the past. And by "economy," I don't mean merely at the government/industry level - I mean the economy of individual families too. In the case of families, returning to the old theories of living within their means, saving for the future and avoiding using credit cards may help prevent another mega-recession in the forseeable future.

Many individuals are in the midst of personal financial failure. They've lost their houses and their jobs. In some cases, it really wasn't their fault. People who did their best to live within their means and made reasonable choices deserve society's compassion and support. They deserve the chance to refinance and not be foreclosed upon, if there's any hope they might be able to manage the payments.

But let's take a look at some outstanding cases where individuals need to take some responsibility for their incredibly illogical choices:

We need a country that was once generally based in common-sense behavior and personal accountability from the individual, through businesses and up to the very highest reaches of the government. I hope that will happen again, but, unfortunately, we have a very long way to go.

- Economic Cycles. No matter what we do, the economy will always have some down times. A wise government would have had adequate controls in place so that the economy wouldn't crash and burn very much. However, we haven't had a wise, forward-thinking government in years

- Unfettered Greed. We've been in a period of economic irrational exuberance that encouraged massive greed

- Lack of Oversight. Companies and individuals have engaged in massive fraud and just plain stupid behavior on a scale we haven't seen since the '20s since there was very little governmental oversight (the Republicans were also in control of the federal government for eight years before the Great Depression, another time of little governmental oversight over companies)

Unfortunately, we're dealing with "fundamentalist economists" - people who will always tell you that there is only one way to do something, regardless of empirical evidence. Conservative economists will insist the trickle-down effect of lowering taxes on the rich is the way to go. This may have worked in the early '80s and early '00s, but it clearly hasn't worked in a few years [2012 update - Actually, I'm wrong about this - there's evidence that "trickle down" did not work in the '80s either]. If anything, this may have sent the economy more into the tank. Liberal economists will insist that massive spending programs are the only way to bolster the economy. That might have worked some in the late '30s and the late '60s, but it doesn't work for very long and can lead to additional years of recession.

Different times call for different solutions.

Much as I abhor federal deficits, we need massive but targeted federal spending and that taxes must be raised on people making more than $100,000 a year. This is not the time for trickle-down - this is the time for building up. Our infrastructure is in horrible shape after years of governmental neglect. How many more bridge collapses are we going to have to have before people wake up and see how badly we need another big roads bill? Our government should also be employing more modern methods, such as green energy plans, online medical records and modernizing public education.

Economic isn't physics. Physics describes laws that are consistent. Economics is a much softer science than its practitioners would care to admit. If I drop a ball from the Empire State Building and one from a 737, it's going to always fall at the same rate of speed. Gravity is a constant. But economies do not fall or rise at a constant rate. Psychology plays heavily into economics. After years of irrational exuberance, we seem to in a state of near-irrational economic despair.

Americans deserve some of that despair. Both the investing market and the housing market went completely bonkers over the last few years, because there was almost no oversight. Common sense by governments, institutions and individuals went completely out the window.

My husband and I have been doing pretty well over the last few years. While I have been unable to remain reliably employed, my husband has a good job and we've always been careful about spending. We have savings and a diversified portfolio of investments.

We bought our first house in 1987 and our second in 1993. We put 5% down on the first house and 20% down on the second. We had good a good credit rating. Of course we sweated getting our first mortgage a little, but we knew we'd get it.

We sold our first house during a housing downturn in 1994 and lost money. We had a lasting lesson that housing prices don't just go up. And, this was in Massachusetts, a place where the housing market, after 1994, went from being expensive to being extremely expensive.

In 2006, we decided to buy a new house. As my husband manages his group from home and I was unemployed, we could have moved anywhere. After looking at housing prices in several areas, we decided to stay in Pittsburgh, where we have family and friends and could buy much more home for the money. For the same money that bought a largish, new house in rural Western Pennsylvania would have bought a 50 year old ranch in eastern Massachusetts or a one car garage in the Bay area of California. We wanted the space and the quiet, so we stayed here. We're very glad we did!

We put 20% down on our new home. Our mortgage broker tried to talk us out of putting that much down. We were stunned by this attitude, but put 20% down anyway, and later paid most of the money from the sale of our old house (which took nearly six months to sell) against the principal of the new. We also worked to keep the costs of our mortgage as low as possible. Selling stock to buy a house in early 2006 turned out to be a very good move, and staying in the Pittsburgh area was a real win. While the housing prices peaked around then, our house has lost much less value than our stocks have. Since the Pittsburgh housing market had a huge bust back in 1980-1981, it's lost very little value during this housing bust.

While I understand that mortgage brokers and banks were trying hard to get people to buy houses a few years back, their "you don't need to put money down" attitude was incredibly short-sighted. Many people don't understand the importance of paying principal on houses and other investments. While laws should encourage home ownership, they also need to encourage people to put money down, to actually own a percentage of the property.

We could have probably gotten a million dollar mortgage in California or New York, but we would have had barely invested 5% in a house in one of those markets. Living that far beyond our means was completely unacceptable to us. Unfortunately, it wasn't unacceptable to many Americans who did just that over the last 10 years or so.

And that goes for government spending too. The federal government has been mortgaging our children's and grandchildren's future without making the rich pay more taxes. Over the last few years, the number of yachts and luxury mansions owned by Americans skyrocketed. Why do you think that happened? Because the super-rich were the biggest beneficiaries of the Bush tax cuts. Wealthy Americans who can afford to pay more taxes should be paying more taxes. Much as I respect President Obama, his refusal to kill the Bush tax cuts for the rich and give the rich yet more tax breaks was a horrible way to start off his administration.

So what we need is a rational tax/stimulus package includes:

- having genuine governmental oversight (laws with teeth) over industries and over any stimulus money that goes to companies

- spending to improve our infrastructure (and education is infrastructure)

- training everyone, from children through adults, on responsible decision-making about money

- gradually reducing the number of troops abroad

- a small tax cuts for households making less than $60,000 a year

- a small tax increase for households making $100,000-$200,000 a year

- a larger tax increase on income over $200,000 a year (and maybe even an additional tax bracket for people who make over $200,000 a year)

We need to look at new, logical ways to manage the economy, without being rigidly bound to the theories of the past. And by "economy," I don't mean merely at the government/industry level - I mean the economy of individual families too. In the case of families, returning to the old theories of living within their means, saving for the future and avoiding using credit cards may help prevent another mega-recession in the forseeable future.

Many individuals are in the midst of personal financial failure. They've lost their houses and their jobs. In some cases, it really wasn't their fault. People who did their best to live within their means and made reasonable choices deserve society's compassion and support. They deserve the chance to refinance and not be foreclosed upon, if there's any hope they might be able to manage the payments.

But let's take a look at some outstanding cases where individuals need to take some responsibility for their incredibly illogical choices:

- Anyone who put all their financial eggs in one basket, from the folks at Enron to the folks who turned over all their money to people like Bernie Madoff. Diversification has been the primary rule of investing for generations. That's one thing that hasn't changed.

- People who support others no matter how ludicrously they behave. Sorry, the woman in California who went bankrupt helping her daughter have 14 children is as certifiable as her daughter is. (I have a bad feeling some cable channel will launch a reality show around these folks, but the proliferation of "reality" shows that do nothing but promote irresponsibility is a wholly separate rant.) People need to make rational choices. Parents need to tell their children "NO" sometimes.

We need a country that was once generally based in common-sense behavior and personal accountability from the individual, through businesses and up to the very highest reaches of the government. I hope that will happen again, but, unfortunately, we have a very long way to go.

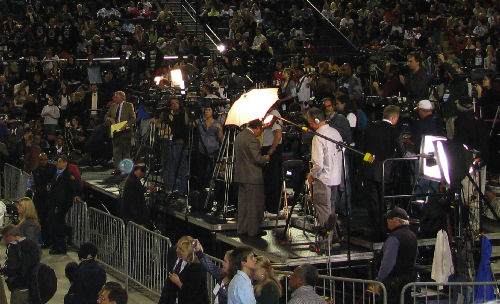

I walked towards the Lincoln Memorial, but the line into the concert wasn't moving much. I walked up the hill to the Washington Monument. There was a crowd on the Lincoln Memorial side of the Washington Monument, but there was still plenty of space.

I walked towards the Lincoln Memorial, but the line into the concert wasn't moving much. I walked up the hill to the Washington Monument. There was a crowd on the Lincoln Memorial side of the Washington Monument, but there was still plenty of space.

Some of the Jumbotrons were set up on the Lincoln Memorial side of the Washington Monument, along with an odd police vehicle that looked like a viewing booth atop a huge scissor-lift.

Some of the Jumbotrons were set up on the Lincoln Memorial side of the Washington Monument, along with an odd police vehicle that looked like a viewing booth atop a huge scissor-lift.

The Jefferson Memorial was pretty dead during the weekend.

The Jefferson Memorial was pretty dead during the weekend.